Comprehensive Reporting

Comprehensive Reporting Suite

Access free and powerful reporting tools to measure performance and monitor activity.

The Interactive Brokers Reporting Advantage

- PortfolioAnalyst, our free tool for linking investment, banking, checking, incentive plan and credit card accounts into a complete portfolio view to calculate returns, understand risks and measure performance against benchmarks.

- Historical data and reports, including data more than three years old, is available for free.

- Advanced custom reporting capabilities, including powerful flex queries that let you perform highly segmented analysis.

- Export data to a variety of flexible formats, including text, .CSV and PDF.

- Consolidate, track and analyze complete financial portfolios with PortfolioAnalyst.

- Powerful account reporting on activity, trade and risk, plus advanced client reporting capabilities for institutional clients.

- Reporting integration with a variety of third-party portfolio management software providers.

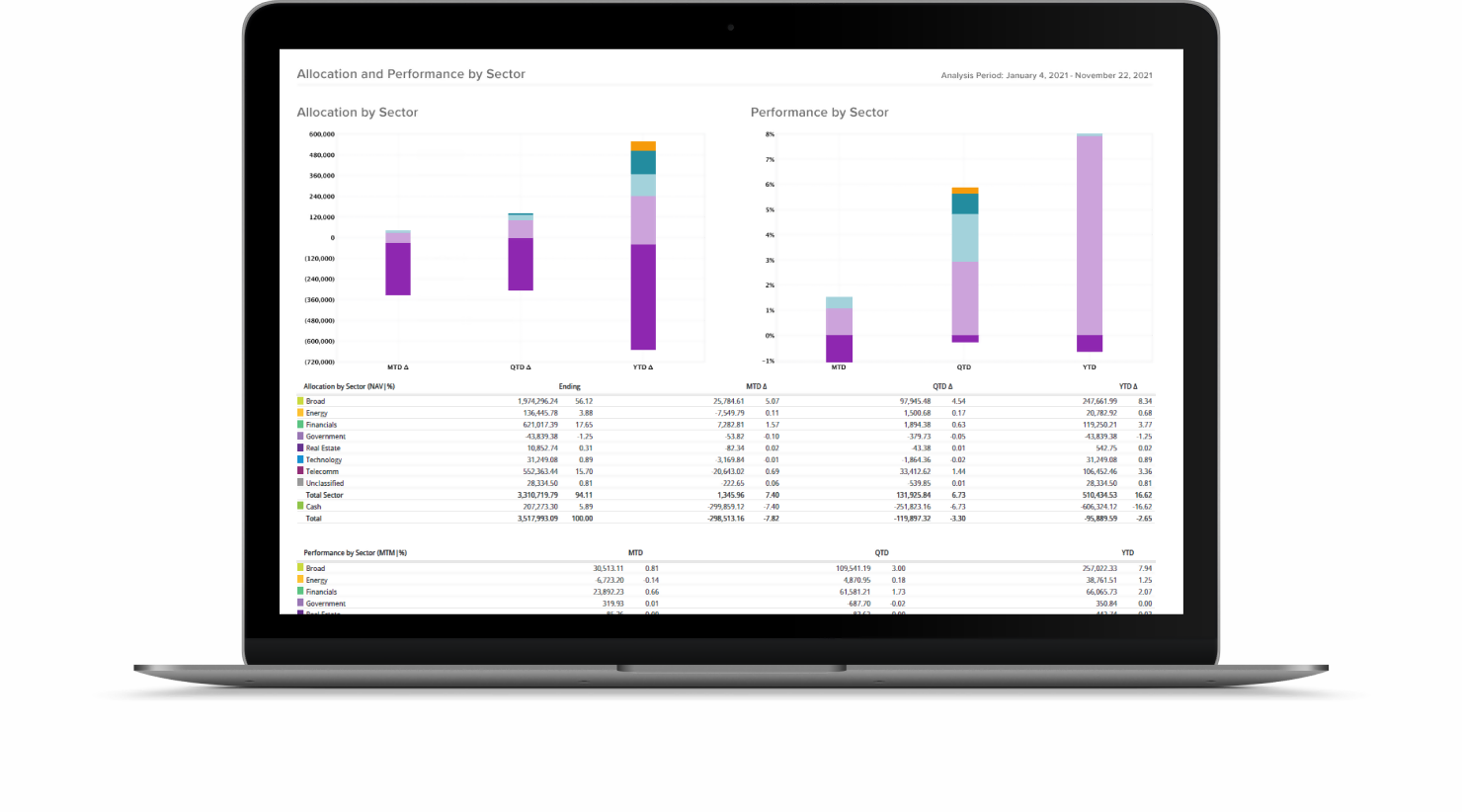

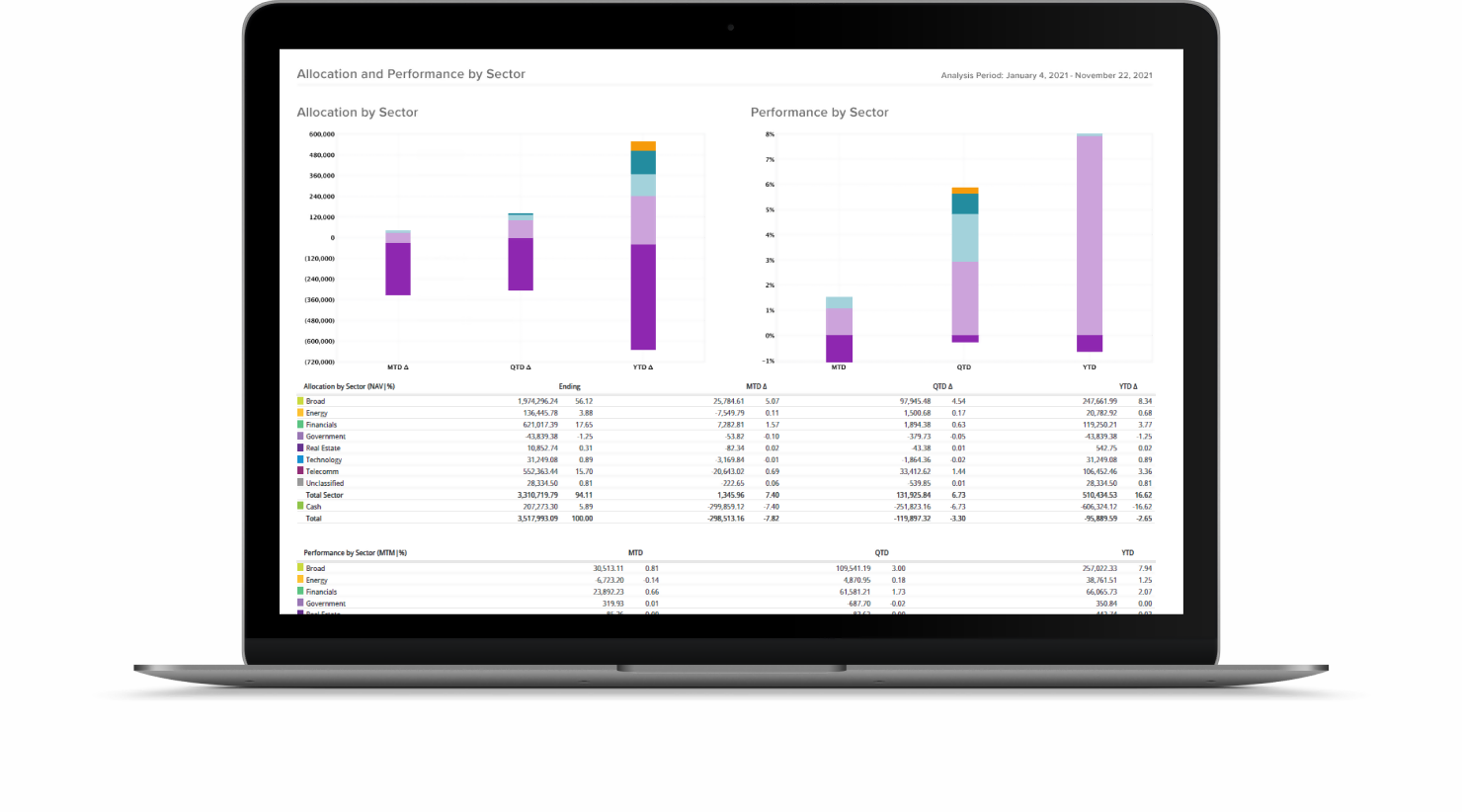

PortfolioAnalyst

The New Standard for Portfolio Management Software and Account Aggregation

PortfolioAnalyst® consolidates, tracks and analyzes your portfolios, offering multi-custody solutions, advanced reporting, global support, benchmarks, risk metrics, GIPS® verified returns and powerful on-the-go analytics. Whether you are new to trading or an advanced investor, start adding accounts today.

PortfolioAnalyst for Individuals

PortfolioAnalyst for Institutions

Tax Information and Reporting

Current and historical tax forms are available within Portal. In addition, our website provides resources for determining your country of residence for tax purposes, a summary of key reports and dates for the current tax year, detailed tax information for persons and entities, FAQs and additional useful information.

Analyze Your Accounts

Our clients have access to a variety of customizable reports and statements for analyzing performance and reviewing account activity in detail.

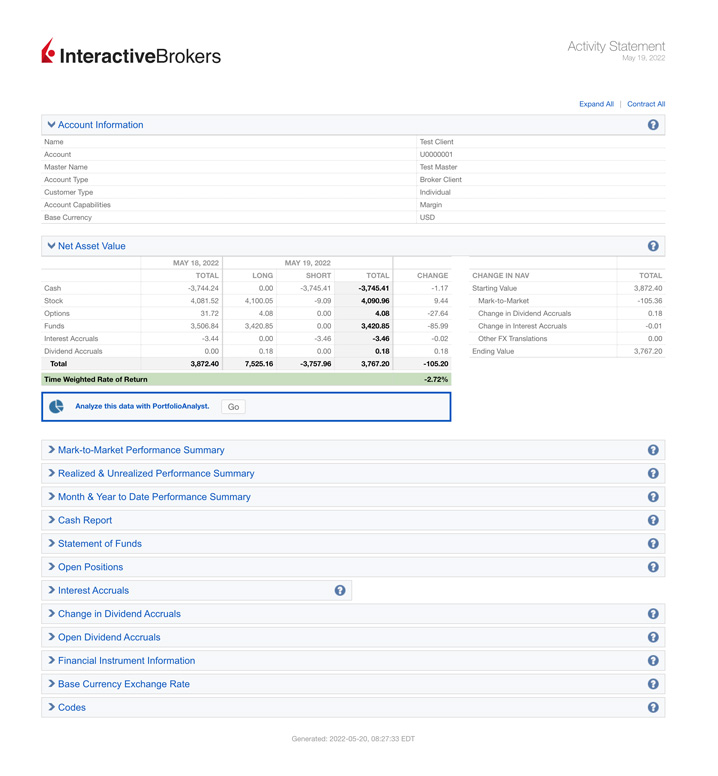

Activity Reports

Our customizable activity reports are available on-demand in a variety of formats, so you can easily track your activity on a daily, monthly, yearly or date-range basis.

Sample Reports

Statement

Standard and customized statements are available as interactive online statements and downloadable PDFs.

Flex Query

Flex queries let you create highly customized report templates for analyzing account activity in detail. Export results in text or XML formats.

Quarterly Summary

Quarterly Activity Summary reports are a simplified quarterly activity statement for Advisors and their clients.

Model Summary

View activity and performance for your models to more efficiently manage multiple trading strategies.

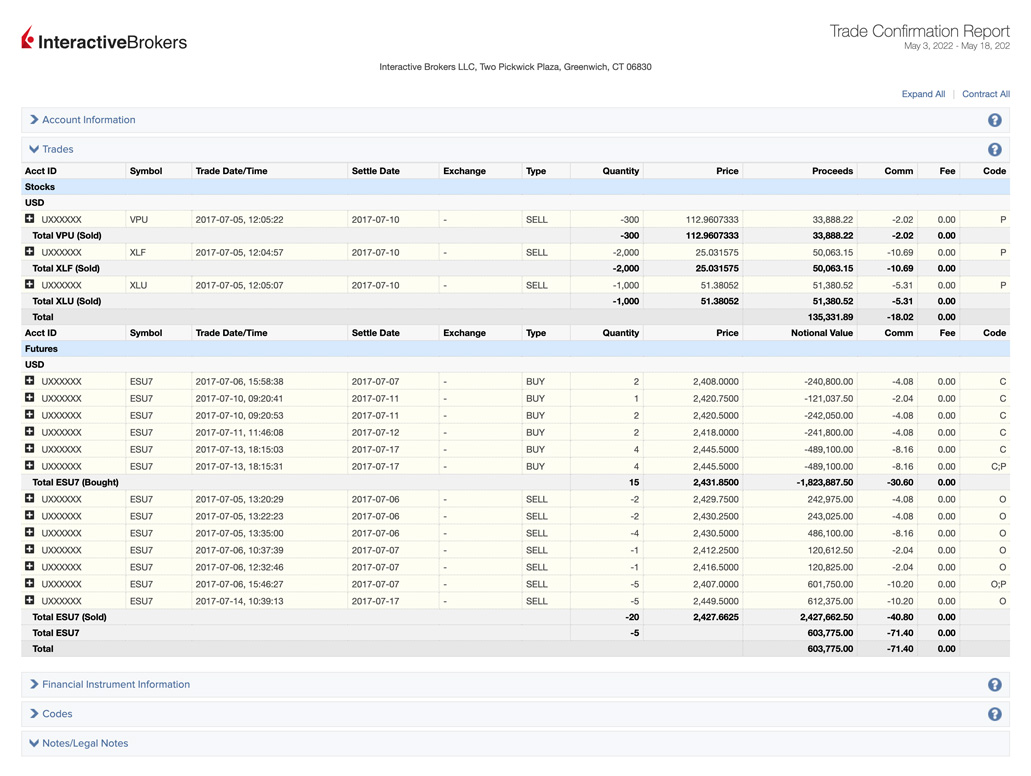

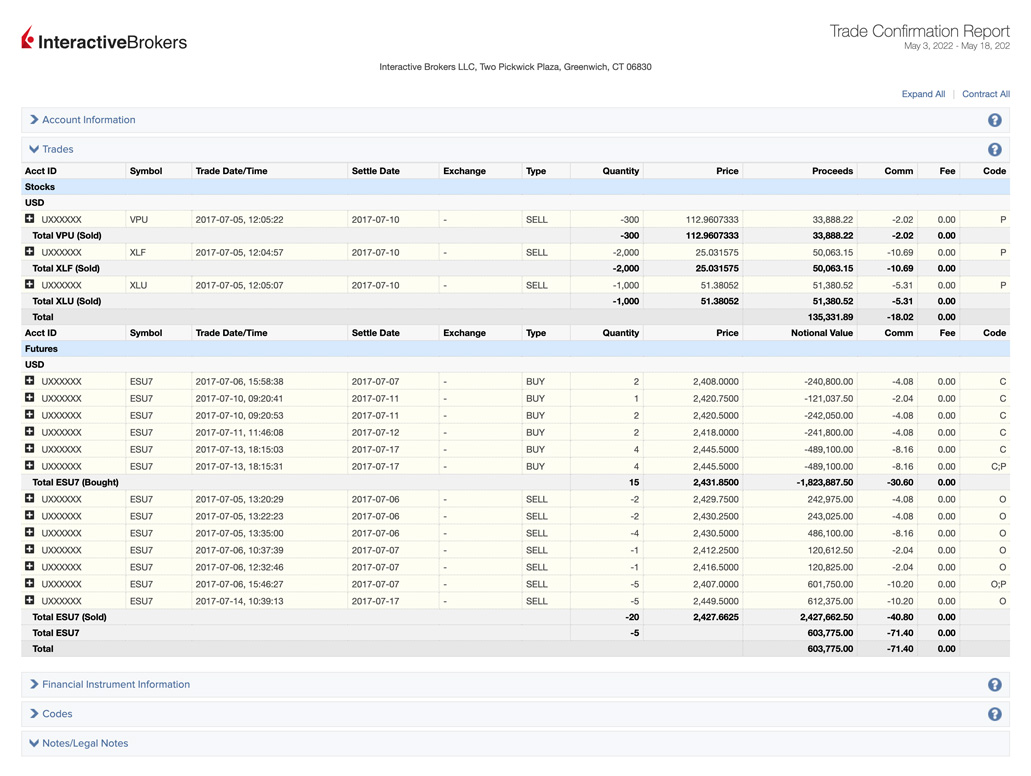

Trade Reports

Track your trading activity, including intraday trade confirmations, or create customized reporting templates for monitoring trade detail.

Sample Reports

Confirmations

Analyze your intraday trade confirmations by asset class.

Flex Query

Use customizable report templates for reporting trade confirmations and export data to text or XML files.

Allocation Report

Master account users can view pre-trade and post-trade allocation details for clients clearing away from IBKR.

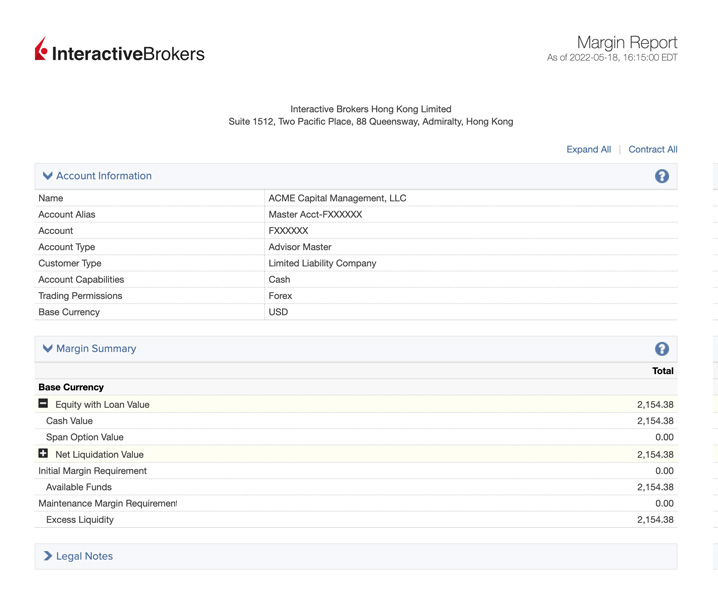

Risk Reports

Monitor risk and forecast portfolio performance using our margin, value at risk and stress test reports.

Sample Reports

Margin Report

Estimate your margin portfolio’s returns based on exposure to market movements over a defined time horizon.

Value Risk

Quantify the potential losses for a portfolio over a defined time horizon.

Stress Test

Estimate changes to your portfolio’s value and P&L based on increases or declines in an underlying price.

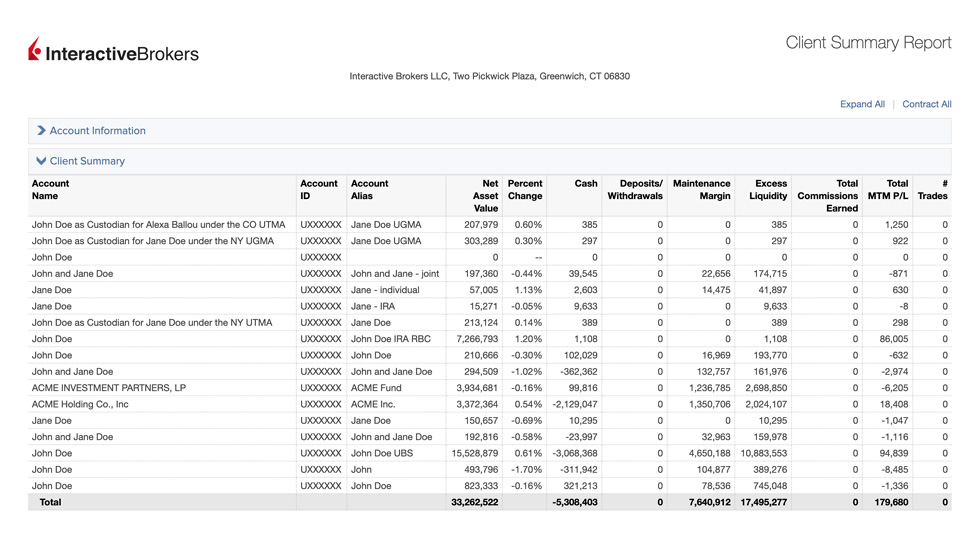

Reports for Financial Advisors

We offer a full suite of reports to help you run your business and manage clients.

Sample Reports

Reports for Introducing Brokers

Our reporting solutions help you supervise client activities and efficiently manage your business.

Sample Reports

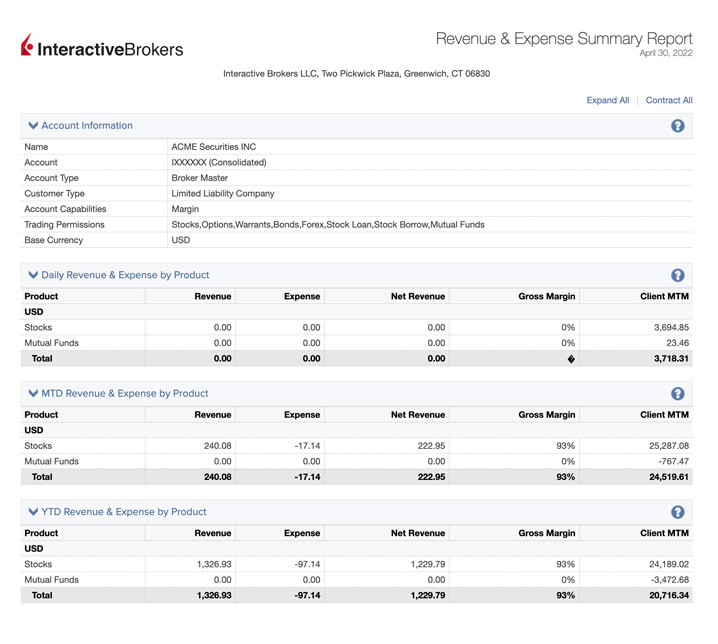

Client Revenue Expenses

Get a snapshot of client revenues, net revenue, gross margin and aggregate client mark-to-market.

Client Summary

View client balances and performance over a one-day period.

Reports for Compliance Officers

Our compliance reporting helps build confidence and trust. The IBKR Compliance team will provide reports to help you ensure your business and operations remain in compliance with applicable regulations.

Contact our institutional sales team to learn more.

For Prop Traders and Hedge Funds

IBKR’s OMS delivers incredible value for institutions looking for a best-in-class order management system. OMS clients have access to a variety of reports and files that can be delivered daily to ensure your back office and operations teams have the information they need.

Contact our institutional sales team to learn more.

Additional Features

Flexible Download Formats

Statements can be downloaded in a variety of formats, including text, PDF, CSV or HTML, for use with third-party tools like Quicken, Tradelog or CapTools.

Consolidated and Concatenated Reports

Consolidate statement and activity data from multiple accounts into a single statement. Concatenated statement and activity data joins full statements for all selected accounts into a single statement.

White Branding

White brand statements, reports and other informational materials with your own organization’s identity, including performance reports created by PortfolioAnalyst.

Reporting Software Integration

Manage your investments and analyze your portfolio with a variety of tools by requesting integration with numerous third-party portfolio management software providers.

Batch Reporting

Our optimized reporting systems efficiently batch and process large reports and notify you once processing starts. FTP delivery is available for very large statement files.

Tax Optimizer

Manage gains and losses for tax purposes by using Tax Optimizer to change tax lot-matching methods on the fly.